- Ahead of the Curve

- Posts

- Trend Alert: Reformer Pilates

Trend Alert: Reformer Pilates

Why are studios sold out, investors piling in, and TikTok obsessed with Reformer Pilates?

Hello, and welcome to another week of Ahead of the Curve.

Reformer Pilates has been around for some time now. But it’s having a huge surge in popularity recently.

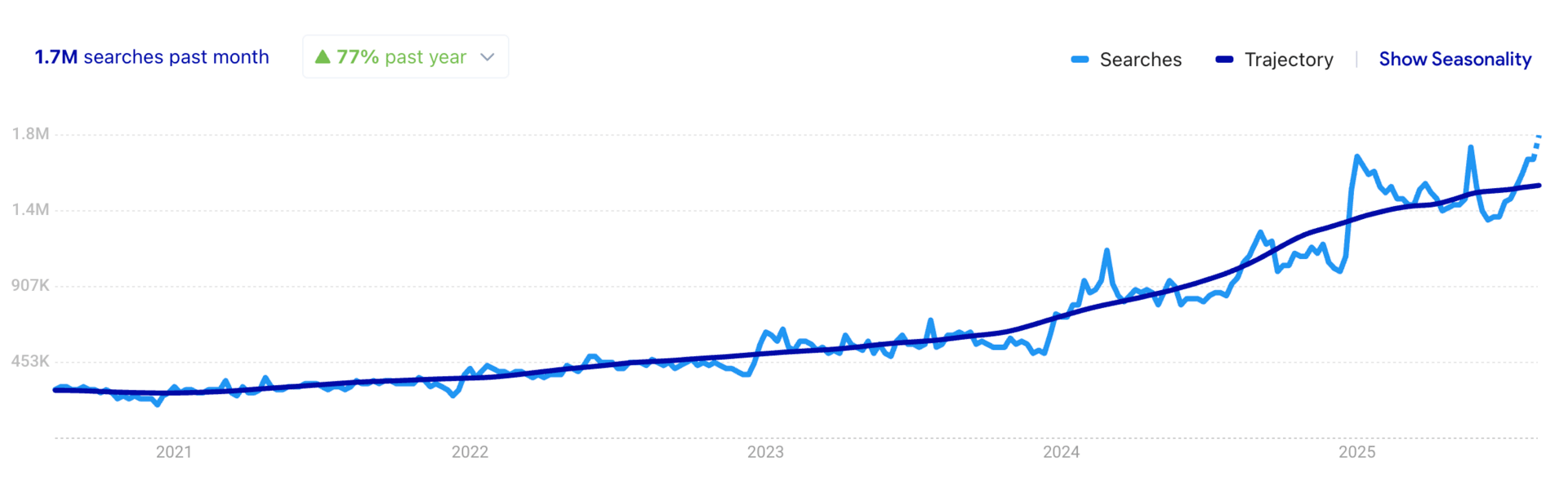

Search Term: “Reformer Pilates” | Last 5 Years | Worldwide

Reformer Pilates has quietly dethroned HIIT and CrossFit as the workout of choice.

Studio waitlists are full, at-home reformers are selling out, and investors are writing big checks.

The question: how can entrepreneurs ride the wave before it peaks?

👀 Things Worth Checking Out

Find Your Next Million-Dollar Idea with 43 proven frameworks to help you generate profitable business ideas on demand.

Access the internet’s largest database of business ideas - over 10,000 ideas with startup guides, growth strategies, and niche opportunities.

The best businesses solve specific problems, so we created a database with hundreds of problems begging for a solution.

😘 Our Other Newsletters

What's the Problem?: Five problems, trends, or stats you can turn into a business. We find the opportunities, you build.

New Venture Weekly: Do you want to start a new business but don’t have an idea? Get realistic business ideas & learn how to build them every week.

🧐 The Trend Explored:

Reformer Pilates is a low-impact, resistance-based workout done on a spring-loaded sliding carriage (the “reformer”).

It was originally designed by Joseph Pilates during WWI to help injured soldiers regain strength.

Today, it’s known for building core strength, flexibility, posture, and lean muscle through controlled, mindful movement.

Why it’s booming now:

A perfect storm of TikTok hype, celebrity adoption, and the post-pandemic wellness shift has pushed Reformer Pilates into the mainstream.

Matcha, skincare Gen Z / Zillenial girlies in gentrified areas.

Pilates is what Yoga was in the 2000s.

Cultural signals:

Pilates was the most-booked workout globally two years in a row on ClassPass.

Studio bookings are up 90%+ year-over-year.

Search demand is at an all-time high, with studios reporting waitlists across major cities.

This is no short-lived fad. About 13M Americans tried Pilates in 2024, and demand is outpacing supply across studios, equipment, apparel, and content.

Entrepreneurs have a rare window to launch the “next big Pilates idea” while the category is still exploding.

Market Dynamics

Size & growth: Pilates sits inside a $160B global studio industry growing at ~10% annually. The Pilates equipment market alone is on track to hit $450M+ by 2030, growing double-digits each year.

New categories emerging:

Smart at-home reformers ($2–5k units with on-demand content).

Digital class platforms (apps, livestreams, Apple Fitness+ integrations).

Accessories & apparel (grip socks, props, activewear designed for reformers).

Investor activity:

Frame Fitness ($5M seed) → foldable at-home reformer.

Flexia ($4M) → AI-guided reformer.

Reform RX ($5.1M) → luxury connected reformer for gyms/hotels.

[solidcore] rumored $750M+ sale → shows how valuable successful Pilates chains can be.

Competitive landscape:

Studios: Club Pilates (1,000+ global), BODYBAR Pilates, STRONG Pilates (80+ studios, expanding to UK).

Equipment: Balanced Body, Merrithew (STOTT), AeroPilates, and new DTC entrants.

Digital: Pilates Anytime, Alo Moves, thousands of micro-instructors on TikTok/IG.

Takeaway: The industry is rapidly professionalising, but whitespace exists in underserved regions, at-home innovation, and hybrid offerings.

Consumer Behaviour Trends

Train smarter, not harder: People are ditching HIIT and bootcamps for low-impact workouts that still deliver results. Pilates is seen as effective and restorative — you leave class energized, not destroyed.

Broader demographics:

Men now make up 20–30% of some classes, helped by athlete endorsements.

Age span is wide: college students through retirees.

Studios are segmenting offerings (athlete-focused, pre/postnatal, senior-friendly).

Lifestyle spend:

The “Pink Pilates Princess” aesthetic has gone viral — pastel outfits, matcha, skincare routines tied to Pilates mornings.

Big spend on class packs ($30–$50/session), home reformers, grip socks, coordinated outfits, and wellness add-ons.

Some consumers cancel gyms or HIIT packs to fund Pilates memberships.

Digital community:

TikTok trends (#WallPilates, #30DaysOfPilates) bring millions into the funnel.

~70% of studios now livestream/on-demand classes.

Community loyalty is strong: referrals, online forums, and gamified tracking (apps, wearables).

Signal: Pilates is more than a workout — it’s becoming a lifestyle identity, much like yoga in the 2000s.

Product Innovation Opportunities

1. Smart At-Home Reformer Subscription

Angle: “Peloton for Pilates” — sleek, foldable reformer with sensors + AI form feedback.

Model: B2C hardware ($2–3k) + recurring content ($30–50/mo). B2B upsell to hotels/apartment gyms.

Why: Studios can’t meet demand; enthusiasts want flexibility and convenience.

2. Hot Pilates Hybrid Studio

Angle: Infrared-heated reformer classes with added strength/cardio.

Model: Boutique studio memberships ($180–250/mo) + franchising potential.

Why: Adds intensity and novelty, appealing to men and HIIT fans while keeping Pilates at the core.

3. Men’s “Athlete Pilates” Program

Angle: Position Pilates as mobility + injury prevention for sports and strength training.

Model: App subscription ($15–20/mo), workshops, or licensed content for gyms/PTs.

Why: Male adoption is rising, but positioning is lacking. Framing as “core training for athletes” lowers barriers.

4. Pilates Lifestyle E-commerce Brand

Angle: Apparel, grip socks, props, and recovery products tailored to the Pilates aesthetic.

Model: D2C store + influencer collabs; mid- to high-ticket; option for subscription boxes.